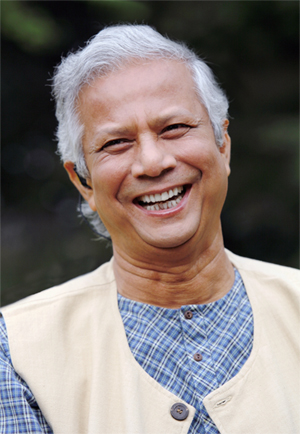

“Our aim is for the New Hampshire Social Business Challenge to serve as an innovation accelerator” was how Yusi Turell of the Carsey Institute described the intent behind this first-ever Business Challenge in New Hampshire. The Challenge involved teams submitting proposed designs for innovative, business-oriented solutions to pressing social and environmental issues at the state, national or global level. There was one track for students and one track for community members, with cash prizes and technical assistance for first, second, and third place in each track. The business idea could be in concept stage. More details on the design of the Challenge is available here and videos and details on the winners are at this link. I was honored to participate by serving as a preliminary judge of contestants for the Challenge and had the opportunity to attend the Social Business and Microfinance Forum where the winners were announced and Muhammad Yunus offered a keynote speech. Yunus is a winner of the Nobel Peace Prize for his work creating the Grameen Bank, which offers small loans to entrepreneurs in poor communities in Bangladesh. The model of microcredit has spread globally  as an effective means to enable people to rise out of poverty.

as an effective means to enable people to rise out of poverty.

From the perspective of designing an event to accelerate innovation and widely engage and spread the concept of social business – i.e., a business that is designed to help solve an environmental or social challenge –this event was a great success. 65 teams submitted entries (39 student teams and 26 community teams.) Entries from students included students in 18 different majors, in many cases ideas to solve challenges came together across disciplines. Fiona Wilson, Assistant Professor at the Paul College of Business & Economics at UNH, said “we tapped into a stream of entrepreneurial spirit across New Hampshire.” The Challenge also engaged the broader community, for example, about 40 social business leaders were invited to be preliminary or final judges and over 20 partner organizations were engaged in spreading the word to encourage people to apply. A crowdfunding campaign helped raise funds for the prize money. In all, organizers estimated that 500 people contributed to this event. When you consider how each person involved discussed it with their networks of colleagues, friends, and families, the ripple effects are even greater.

The stories of social businesses told at the event illustrated a different way thinking about how to address a problem. Yunus told the story of how he started the concept of microcredit. He was teaching economics in a university and recognizing that these economic theories were doing nothing to help many people suffering in extreme poverty and hunger in Bangladesh. “It was a compulsion of the circumstances that led me to this – such a pressing need, I just had to act. I had no thought of starting a bank, I just wanted to protect these people from loan sharks. I loaned a total of $27 dollars and served as guarantor of the loans. All got repaid.” His shift of thinking was to offer credit rather than a donation: “With philanthropy or aid, where you raise money, it goes out, then you have to raise more, using a business model of loans, the money goes out, you help the people succeed in their business, the money comes back with interest, and then more can go out.”

Yunus said “why not add social business into the theoretical framework of capitalism? There can be two kinds of businesses: those focused on making money and those focused on solving environmental and social problems. Business has the capital, creative power, technology, and people –we are not using this to solve problems. Instead we are saying “government” should do it.”

In a local example of a social business inspired in part by Yunus, Juilana Eades of the New Hampshire Community Loan Fund shared how when she was a student at UNH, someone she knew lived in a manufactured housing park where the land was going to be sold. The owners of the homes own the trailer, not the land underneath it. She worked with her professor at UNH and some part-time MBA’s to devise a way the people could collectively buy the land. The homeowners all pay rents and that money combined is economic power. What started as an idea with her professor has now grown to become the New Hampshire Community Loan Fund, an $82 million enterprise that has helped grow the number of resident-owned communities in New Hampshire from 13 to 107. Paul Bradley, President of ROC USA, received a Social Innovator of the Year award at the event for his work to take the strategies developed in New Hampshire national.

It’s fun to imagine if we could someday track all the outcomes of the conversations and ideas that this Business Challenge sparked. This event demonstrated a way that a university can engage its students, professors, and the broader community by galvanizing new conversations and innovative ideas, offering a new frame on how we can address our most pressing challenges. Yunus said “The distance between possible and impossible is shrinking – it all comes down to what we can imagine.” And speaking to the role of the university, he said “we should focus on helping students imagine and create the world that they want to see rather than training them to fit into the world as it is.”